Chaitali Bag

Asia-Pacific’s aviation sector is experiencing an exhilarating metamorphosis, firmly establishing itself as a linchpin of global air travel as booming economies, expanding middle classes, and hefty infrastructure investments converge to fuel a powerful post-pandemic resurgence; domestic traffic has already surged past pre-2020 levels in many markets—propelled by government initiatives and voracious consumer demand—while international travel, though still constrained by lingering restrictions, policy shifts, and geopolitical tensions, is gradually adapting as carriers reconfigure networks, pursue alternative routes, and capitalize on the democratizing rise of budget airlines, all amid a near-term outlook that forecasts the region’s passenger numbers to climb by 7.9% into 2025 and a long-term trajectory that could see volumes double by 2043, driven by dynamic markets like China, India, Vietnam and Indonesia and accelerated by technological innovations such as AI-driven route optimization and biometric verification—yet stakeholders must remain agile to navigate inflation, fuel volatility and geopolitical uncertainties that could temper this otherwise remarkable growth story.

Wouter Van Wersch, President and Executive Committee Member of Airbus, recently delivered a compelling, optimistic view of Airbus’s current strength and future trajectory—especially as it deepens its roots and accelerates activity across the Asia-Pacific region. His remarks painted a portrait of a global aerospace leader that is large-scale, dynamic in innovation, and resolutely committed to local partnerships, industrial investment, and sustainability. The Asia-Pacific is not merely a market for Airbus; it is a strategic hub for manufacturing, engineering, talent development, supply-chain resilience, and technological collaboration. At Singapore Airshow 2026, Van Wersch explores Airbus’s overall performance, the company’s Asia Pacific ambitions, concrete industrial expansions in China and India, the robust regional supply chain and sourcing story, and the company’s investments in maintenance, training, and future aviation technologies—framed by a bold commitment to sustainability.

Airbus at scale: performance, momentum & balanced growth

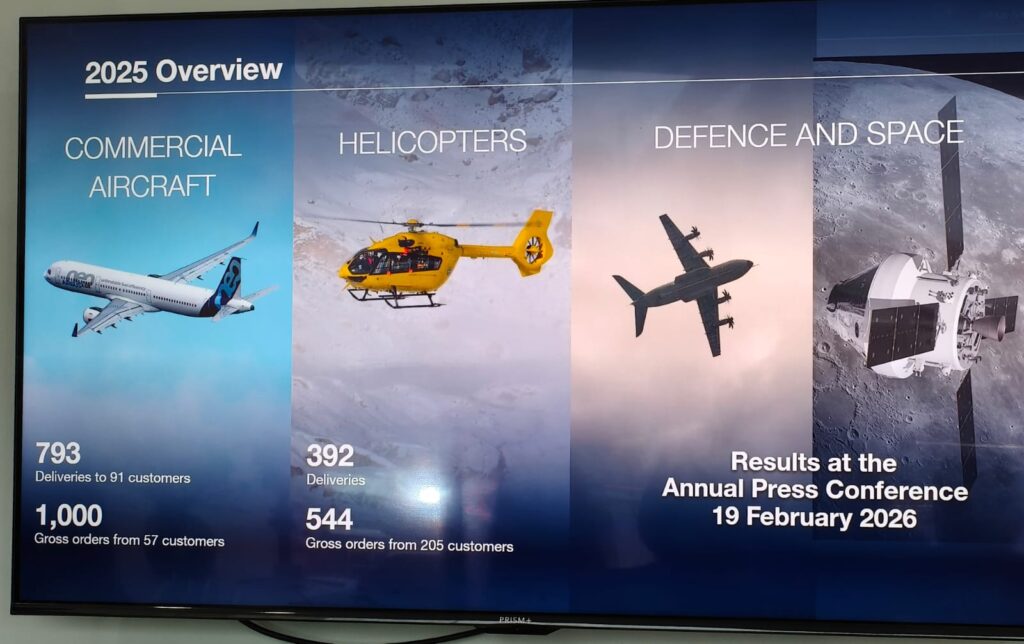

Airbus today is a titan of global aviation and aerospace, employing nearly 160,000 people worldwide and delivering capabilities that connect societies, enhance security, and drive technological progress. Van Wersch highlighted how Airbus’s worldwide performance remains strongly positive: over 16,000 aircraft have been delivered to some 450 customers to date, reflecting both scale and trust in Airbus platforms. The company’s recent operational cadence—793 aircraft delivered in 2024 and a net book-to-bill of 1,000—signals a healthy, resilient commercial business, even as the industry normalizes following recent global disruptions.

Beyond commercial aviation, Airbus’s helicopter division posted notable momentum, delivering nearly 400 helicopters and securing 544 orders—clear evidence of demand across civil, parapublic, and defence markets. Defence and Space activities also showed strength, with the promise of fuller disclosure and detail to come, reinforcing that Airbus is not a one-dimensional manufacturer but a diversified aerospace group capable of delivering across sectors.

Asia Pacific: A region of strategic significance

From Van Wersch’s remarks, it was unmistakable that Asia Pacific ranks among Airbus’s highest strategic priorities. Airbus’s presence in the region is deep and enduring: more than 9,000 employees and a five-decade history reflect long-term commitment and institutional experience. But Van Wersch’s message was about momentum, not just legacy. The region serves multiple critical roles for Airbus—product delivery hubs, collaboration nodes with airlines and governments, centers for supply chain integration, and crucibles for innovation.

Airbus’s focus in the Asia Pacific is multifaceted. It is expanding industrial footprints, building local talent pipelines, and strengthening relationships with national stakeholders. Key markets such as Korea, Japan, India, Singapore, and China are singled out as pillars of Airbus’s regional strategy, each offering unique strategic advantages: indigenous industrial capacity, technical talent, regional logistical advantages, and forward-looking policy frameworks. The company’s approach is collaborative and long-term: work with airlines to responsibly grow fleets, partner with governments on defence and civil programs, and invest in people and capabilities to enable sustainable aviation growth over the coming decades.

Manufacturing & industrial footprint: Concrete investments in China & India

Van Wersch highlighted major industrial milestones that demonstrate Airbus’s commitment to on-the-ground capacity in the Asia Pacific. In China, the launch of a second A320 Family Final Assembly Line (FAL) in Tianjin signifies Airbus’s responsiveness to local demand and its willingness to expand production where it matters. The Tianjin FAL strengthens Airbus’s ability to serve regional airlines with locally assembled aircraft while deepening industrial ties and supply relationships within China.

India, however, emerged from Van Wersch’s remarks as a focal point for accelerated industrialization and strategic partnership. Airbus’s collaboration with Tata to establish a C295 military transport aircraft final assembly line in India is poised to produce the first “Made in India” C295 in the second half of this year—a watershed moment for India’s defence aviation industrialization and for Airbus’s regional manufacturing footprint. Complementing this, an H125 helicopter final assembly line is expected to be announced in February 2024 during a high-profile visit by dignitaries, underscoring the political and industrial momentum behind Airbus’s investments. These moves underscore a thoughtful regionalization strategy: use India not merely as an assembly location but as a platform to supply regional markets across South and Southeast Asia with transport aircraft and helicopters.

Van Wersch also highlighted India’s rise as an engineering and digital hub for Airbus. A new campus in Bangalore, housing over 5,000 employees, signals Airbus’s intent to tap into India’s deep technology talent pool—supporting engineering, software, digital services, and other advanced capabilities. The combination of manufacturing, engineering, and digital presence makes India a strategic linchpin for Airbus in the region.

Supply chain & sourcing: Growing regional integration

Airbus’s Asia Pacific supply chain is expansive and increasingly integrated. Van Wersch identified more than 600 Tier-1 suppliers across the region—industrial partners that produce critical equipment and parts. The monetary story is equally striking: sourcing from the region has scaled from under $1 billion in 2011 to nearly $8 billion today, representing roughly 8–10% of Airbus’s global sourcing. This growth reflects both the rising industrial capability of Asia Pacific suppliers and Airbus’s concerted effort to diversify and deepen its sourcing base.

This supply-chain evolution delivers multiple strategic advantages: improved responsiveness to regional market demand, risk diversification across geographies, cost-competitiveness, and the stimulation of local aerospace ecosystems. By embedding suppliers and partners in the region, Airbus not only secures its production needs but also helps nurture a broad supplier base capable of supporting future generations of aircraft and systems.

MRO, training & localization: Building capability & resilience

Operational readiness and lifecycle support are central to the needs of airline and defence customers, and Airbus is investing heavily in Maintenance, Repair, and Overhaul (MRO) networks and training facilities across the Asia-Pacific region. Van Wersch noted a broad helicopter MRO footprint spanning countries such as Japan, Australia, New Zealand and Malaysia, ensuring operators have timely, localized maintenance capability. In Singapore, ST Engineering stands out as a key partner, supporting maintenance for strategic platforms such as the MRTT tanker, while Airbus aims more broadly to localize servicing and maintenance wherever feasible, bringing capability closer to customers.

Training and skills development are equally vital. Airbus has established robust training centers in Bangalore and Delhi to develop pilot, technician, and engineering talent. These centers not only support operational safety and reliability but also cultivate the workforce required to sustain and grow the region’s aviation ecosystem.

Technological collaboration & global diffusion: New tanker tech & beyond

Van Wersch’s overview also highlighted how regional collaboration can produce innovations with global applicability. One salient example is the development of a new automatic boom refuelling technology in partnership with the Singapore Air Force. This automatic boom system—designed to increase refuelling efficiency and safety—will be rolled out globally, demonstrating how Asia-Pacific partnerships can drive advances that benefit Airbus’s worldwide customer base.

Sustainability & future aviation technologies: Committing to a greener future

Interwoven through Airbus’s industrial and commercial plans is a firm commitment to sustainability and the decarbonization of aviation. While Van Wersch’s remarks emphasized concrete industrial expansions and supply-chain depth, the underlying imperative is clear: Airbus must develop and deploy technologies that will enable aviation to meet increasingly stringent environmental goals.

Airbus’s global strategy includes investments in sustainable aviation fuels (SAF), hydrogen and electric propulsion research, and aircraft design innovations that reduce emissions and improve efficiency. The company’s Asia Pacific collaborations—whether in engineering hubs, supplier partnerships, or operational partnerships—are integral to testing, validating, and scaling sustainable technologies. By anchoring R&D, manufacturing, and operational experiments in the region, Airbus can both leverage local talent and provide regional customers with pathways to greener operations.

Broader implications: Economic development, skills & regional security

The industrial story Van Wersch told has ramifications beyond the aerospace sector. Airbus’s investments catalyze local economic activity, create high-value jobs, and promote skills development across engineering and digital disciplines. Partnerships with companies such as Tata and ST Engineering, as well as with national governments, strengthen industrial ecosystems and contribute to broader economic development goals. In defence and security domains, localized manufacturing and maintenance capacity enhances sovereign capabilities and resilience—qualities that are increasingly important in an era of geopolitical complexity.

Wouter Van Wersch’s perspectives on sustainability and the future of aviation brim with optimism—and for good reason. At a moment when the industry grapples with the dual pressures of soaring demand and an urgent need to decarbonize, his view maps a pragmatic, multi-pathway approach that blends short-term gains with ambitious long-term transformation. The result is an energetic blueprint: keep improving what works today, invest heavily in transition fuels and infrastructure, and simultaneously design the radical aircraft of tomorrow.

First, Van Wersch underscores that progress does not require waiting for radical breakthroughs. Continuous, incremental improvements to current airframes and propulsion—seen across the A220, A320/321neo family, A330neo and A350—are already driving meaningful reductions in CO2 per passenger. Refinements in aerodynamics, weight-saving materials, and engine efficiency are real, measurable wins. Those evolutionary gains matter because commercial fleets are vast and replacement cycles long; enhancing today’s aircraft brings immediate climate benefits while the industry prepares for deeper change.

Building on that practical base, Airbus’s research into a next-generation single-aisle aircraft captures the spirit of mid-term ambition. Targeted for the mid-next decade, this work focuses on markedly improved wings—lighter, thinner, and larger—paired with new engines and advanced systems. Importantly, these designs are rooted in proven technologies, not speculative concepts, accelerating their pathway to certification and entry into service. The goal: deliver single-aisle aircraft that significantly lower fuel burn and emissions while meeting the capacity needs of global air travel growth.

Hydrogen enters Van Wersch’s timeline as the game-changing, long-term solution. Recognizing that hydrogen’s promise depends on more than aircraft design, Airbus is pacing development toward the 2040s—aligned with when hydrogen production, distribution, and airport ecosystems can realistically support commercial operations. This cautious optimism is strategic: hydrogen can enable zero-carbon flight if produced cleanly and supported by robust logistics, but only if industry, regulators, and the energy sector scale in concert. The timeline reflects that systemic view.

In parallel, Sustainable Aviation Fuel (SAF) is a centerpiece of Airbus’s near-term decarbonization strategy—and Van Wersch is explicit about its critical role. SAF can plug into existing fleets and airports today, reducing lifecycle CO2 emissions without waiting for new airframes. Airbus’s commitment—through investments, dedicated funds and partnerships such as engagements with SAF producers in Asia—signals a clear intent to accelerate supply chains and increase availability. That pragmatic embrace of SAF complements the hydrogen roadmap and ensures action across every viable horizon.

Van Wersch also celebrates concrete product innovations that are reshaping route networks and airline business models. The A350’s ultra-long-range capability is unlocking ultra-long-haul travel, enabling routes such as Sydney— London and Sydney— New York, and shrinking the world in unprecedented ways. The forthcoming A350 freighter builds on that platform to modernize cargo operations, with test flights and early deliveries poised to expand global logistics efficiency. Meanwhile, the A321XLR’s success—over 500 orders—demonstrates how a long-range single-aisle can open new city-pair connections, boosting regional connectivity while offering airlines more fuel-efficient options on thin long-haul routes.

Taken together, Van Wersch’s outlook is unabashedly bullish about the aerospace sector’s growth—especially across Asia. He points to booming demand in markets like India, where air traffic is forecast to multiply in the coming decade, and highlights Airbus’s role in cultivating local capabilities and ecosystems. That regional focus underscores a broader truth: decarbonizing aviation demands global cooperation, industrial investment, and a supply of skilled talent and infrastructure across continents.

Wouter Van Wersch conveyed a message of confidence and purposeful action. Airbus is performing strongly at scale, demonstrating resilience in the commercial and helicopter markets while maintaining momentum in defence and space. The Asia Pacific region is central to Airbus’s strategy—an arena for manufacturing, sourcing, talent, and innovation. Concrete investments in China and India, expanded supplier networks, strengthened MRO and training capabilities, and technology collaborations, such as the automatic tanker boom, collectively point to a holistic, long-term approach to regional engagement.

At its core, Airbus’s strategy reflects a recognition that global success depends on deep regional partnerships: invest locally, build capability, share technology, and prioritize sustainability. As Airbus continues to grow in Asia Pacific, it brings with it not only aircraft and systems but also jobs, skills, and technologies that will shape the future of aviation—bringing cleaner, safer, and more connected skies to a region whose aviation story is just beginning to accelerate. The tone from Van Wersch was unmistakable: Airbus is ready to partner, innovate, and invest—boldly and enthusiastically—in Asia Pacific’s aviation future.